What Are Wall Street Analysts' Target Price for PPL Stock?

With a market cap of $26.7 billion, PPL Corporation (PPL) is a diversified utility holding company, serving approximately 3.5 million electricity and natural gas customers. Operating through its Kentucky Regulated, Pennsylvania Regulated, and Rhode Island Regulated segments, the company delivers energy across multiple states and generates power primarily in Kentucky.

Shares of the Allentown, Pennsylvania-based company have underperformed the broader market over the past 52 weeks. PPL stock has returned 19.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 22.1%. However, shares of the company are up 11.9% on a YTD basis, outperforming SPX's 7.9% gain.

Looking closer, the energy and utility holding company stock has slightly outpaced the Utilities Select Sector SPDR Fund's (XLU) 18.1% return over the past 52 weeks.

Shares of PPL fell nearly 1% on Jul. 31 after the company reported Q2 2025 adjusted EPS of $0.32, missing the consensus estimate. Despite a 7.7% year-over-year increase in revenues to $2.03 billion and operating income rising 4.1% to $406 million, investors were likely concerned by higher operating expenses of $1.6 billion and rising interest expenses of $199 million. Segment-wise, Pennsylvania and Rhode Island both saw year-over-year EPS declines, with Rhode Island's adjusted EPS dropping 75% to just $0.01.

For the fiscal year ending in December 2025, analysts expect PPL's EPS to grow 7.7% year-over-year to $1.82. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

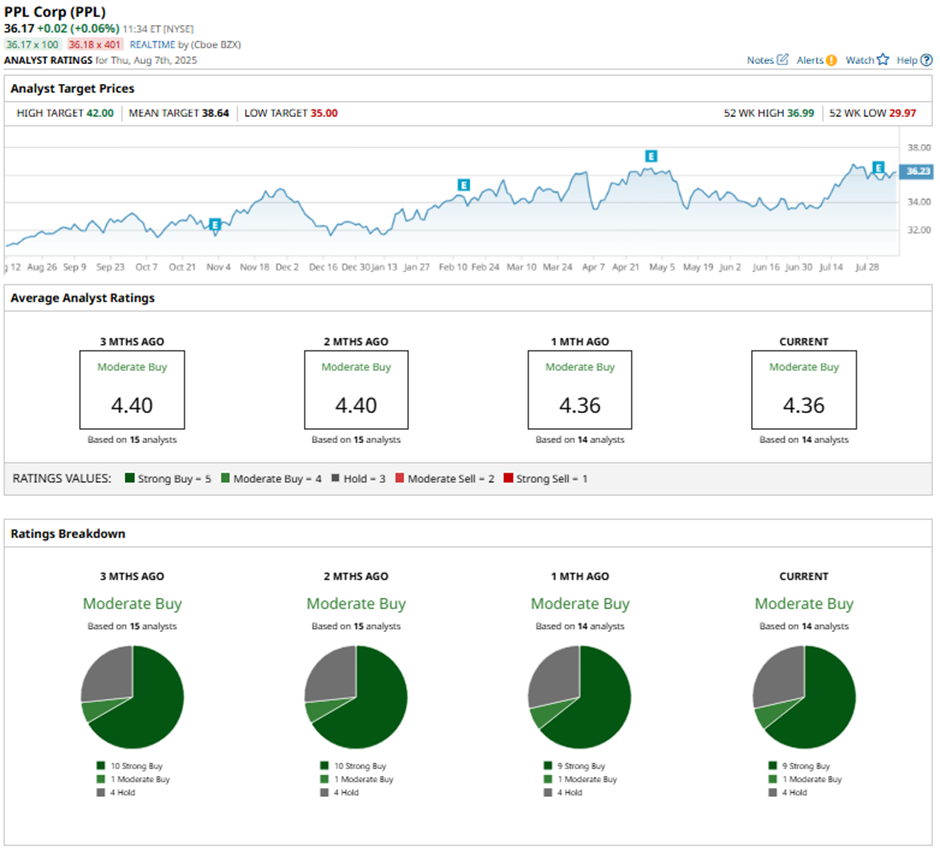

Among the 14 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

On Aug. 4, BofA raised its price target on PPL to $33 while maintaining a “Buy” rating.

As of writing, the stock is trading below the mean price target of $38.64. The Street-high price target of $42 implies a potential upside of 16.1%.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.