General Mills Stock: Analyst Estimates & Ratings

With a market cap of $26.7 billion, General Mills, Inc. (GIS) is a top American provider of branded consumer food products, renowned for an extensive portfolio that spans breakfast cereals, baking mixes, frozen snacks, yogurt, pet foods, and more. Headquartered in Minnesota, the company is known for iconic brands like Cheerios, Betty Crocker, Pillsbury, Nature Valley, and Blue Buffalo.

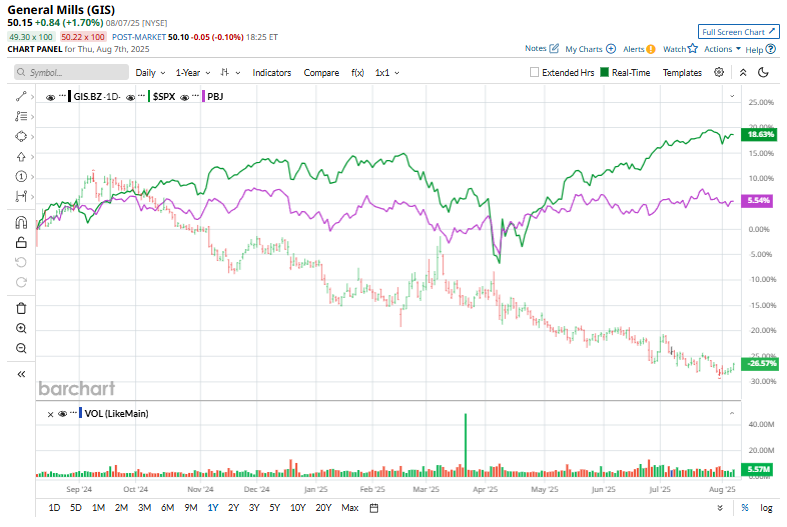

The food giant has significantly underperformed the broader market over the past year, plunging 27.2% over the past 52 weeks and 14.7% on a YTD basis. In contrast, the S&P 500 Index ($SPX) has surged 21.9% over the past year and 7.8% in 2025.

Zooming in further, General Mills has also struggled to keep up with the Invesco Food & Beverage ETF’s (PBJ) 5.9% rise over the past year and 3.1% returns on YTD basis.

Continuing the trend, GIS shares have dipped 5.1% on June 25 after the company released its fiscal fourth quarter earnings. It reported net sales of $4.89 billion, down 6% year-over-year, reflecting lower sales volumes and pricing pressures. Operating profit fell 8% to $805 million, while adjusted earnings per share declined 6% to $1.08.

For the current year, ending in May 2026, analysts expect GIS’ earnings to decline 13.1% year-over-year to $3.66 per share. On the bright side, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

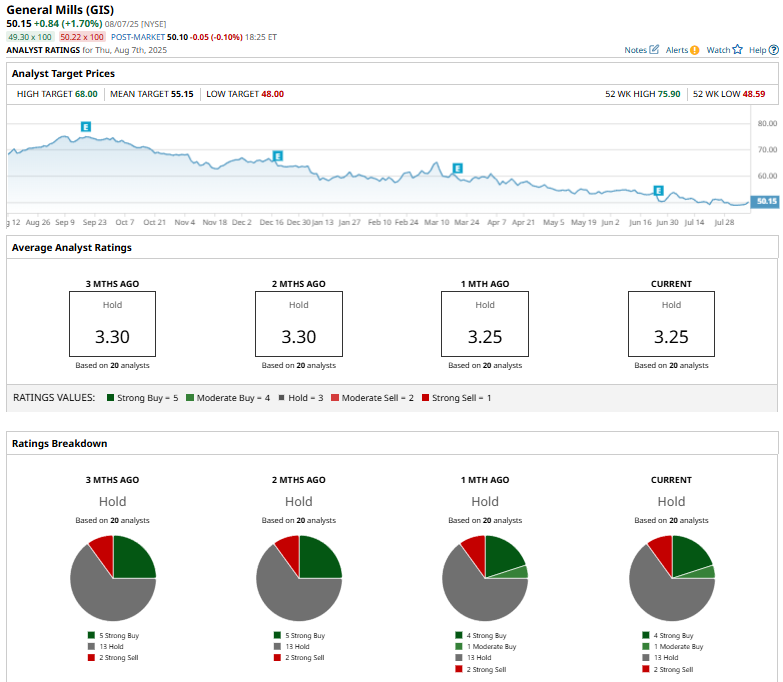

Among the 20 analysts covering the GIS stock, the consensus rating is a “Hold.” That’s based on four “Strong Buy,” one “Moderate Buy,” 13 “Hold,” and two “Strong Sell” ratings.

The consensus rating is more bearish than two months ago when it had five “Strong Buy” rating.

On June 26, Stifel’s Matthew Smith lowered General Mills’ price target from $65 to $56 but maintained a “Buy” rating, signaling continued confidence in the stock despite the reduced outlook.

GIS’ mean price target of $55.15 suggests a 10% premium to current price levels, and its Street-high target of $68 indicates a 35.6% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.