ConocoPhillips Produces Lower FCF and Investors are Bored - But is COP Stock Too Cheap?

ConocoPhillips Inc. (COP) produced lower FCF in Q2, and investors seemed bored with the company. This is despite claims that it would boost free cash flow. Nevertheless, COP stock still looks too cheap here, based on its historical yield metrics.

COP is at $93.28 in midday trading on Friday, Aug. 7, below its pre-earnings price action. For example, it peaked recently at $97.99 on July 29.

Tepid Free Cash Flow Results

ConocoPhillips reported on Aug. 7 that its Q2 operating cash flow (OCF) after working capital changes of $3.485 billion (see page 1 of the Supplemental Data tables).

That was well below the $6.115 billion OCF in Q2 and $$4.919 billion in 2024 Q2.

In addition, for the first 6 months, its OCF was $304 million lower than the H1 figures from last year (i.e., $9.6 billion in H1 2025 vs. $9.904 billion in H1 2024). That represents Y/Y decline of -3.1%.

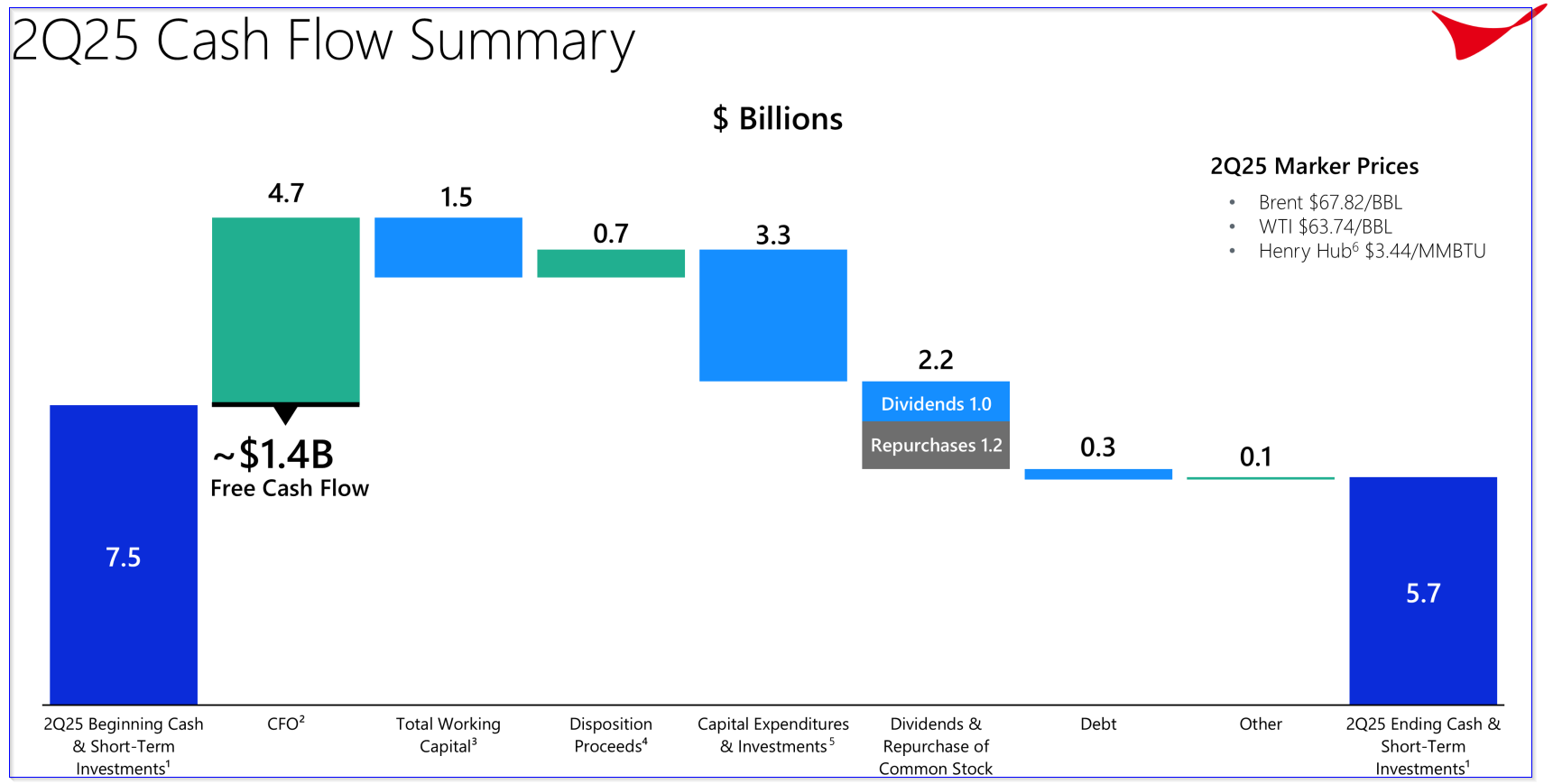

So, as you might expect, investors have not been impressed. Despite slightly lower capex spending (and not including net changes in W/C), ConocoPhillips' adjusted free cash flow (FCF) was reported as $1.4 billion.

However, this did not cover the $2.2 billion cash dividends and share buybacks. This can be seen on page 9 of its shareholder deck.

That could be why Conoco said in its earnings release it will find $1 billion more in cost reductions and margin enhancements.

However, these savings, which could boost FCF, won't kick in right away. Conoco said it will take effect on a “run rate basis by year-end 2026.”

The net result is that Conoco's cash balance dropped, as it was used to finance the dividend and buybacks. That may be why COP stock has been flat for the past 6 months.

Dividend Yield and Price Target

The dividend per share (DPS) payment was kept stable at 78 cents for Q3. That gives the stock an annual DPS rate of $3.12. So, at today's price, COP has a 3.345% dividend yield:

$3.12 DPS / $93.28 price = 0.03345 = 3.345% annual yield

However, it seems likely that Conoco will raise its DPS next year. If it were to raise this by 5% to 82 cents quarterly, the next 12 months (NTM) dividend payments would be:

$0.78 +($0.82 x 3) = $3.24 forward DPS

As a result, its forward dividend yield is higher at 3.473% (i.e., $3.24 / $93.28).

However, that is well below its historical dividend yield. For example, Yahoo! Finance reports that the 5-year average has been 2.64%. Similarly, Seeking Alpha says it's been 2.95%.

Therefore, assuming COP stock eventually reverts to its mean yield of 2.795%, it could trade at:

$3.24 DPS / 0.02795 = $115.92 target price

That provides a potential upside of +24.3% from today's price.

Analysts Agree COP is Undervalued

Yahoo! Finance says the average of 28 analysts is $116.93, and Barchart's mean survey price is $115.36. Moreover, some surveys have higher price targets.

For example, Stock Analysis shows that 16 analysts have an average of $120.38, and AnaChart.com reports that 21 analysts have an average of $118.90.

So, the average analyst survey price target is $117.89, representing a potential upside of +26.4%.

The bottom line is that, assuming ConocoPhillips can get its act together, including raising its FCF profile, COP stock looks undervalued.

The problem is that this could take a while, and COP stock may not reach this upside right away.

As a result, it makes sense to set a lower buy-in price and collect income by shorting one-month out put options in lower strike prices.

Shorting OTM Puts in COP

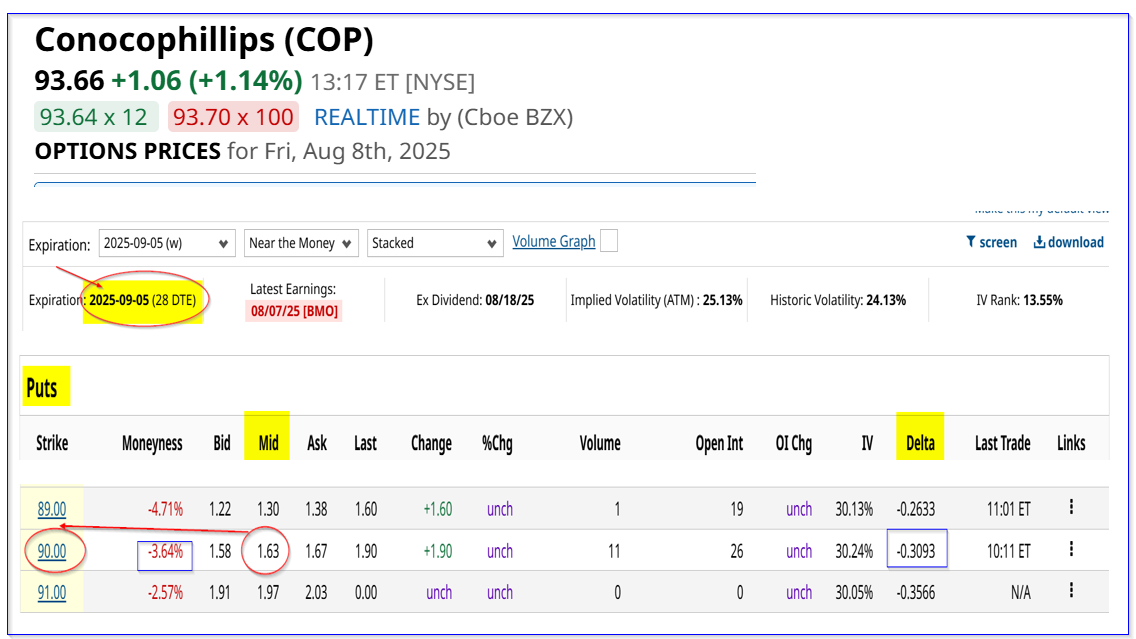

For example, look at the Sept. 5 expiry chain shows that the $90.00 strike price put option has a midpoint premium of $1.63. This strike price is over 3.5% below today's price, i.e., it's out-of-the-money (OTM) and represents a potential lower buy-in point for an investor.

In return, the investor receives an immediate yield of 1.81% (i.e., $1.63/$90.00 = 0.01811 = 1.811%).

This means that an investor who secures $9,000 in cash or buying power, after ending an order to “Sell to Open” 1 put contract at $90.00, can make $163.00. The $9,000 acts as collateral in case COP falls to $90.00 and the account is assigned to buy 100 shares.

The point is that the breakeven price is lower at $90.00 - $1.63, or $88.37. That represents a 5.2% lower buy point for an investor.

More risk-averse investors can look to sell short the $89.00 put strike price. That premium is lower at $1.30, but the one-month yield is still attractive at 1.46% (i.e., $1.30/$1.89).

The bottom line is that this is a way for investors to get paid while waiting to see if COP stock will fall. It also allows an investor to get a lower buy price while waiting.

Investors can learn more about how this works at the Barchart Options Learn Center, where there are a series of tutorials explaining various options strategies. For example, two popular strategies are covered call and short-put plays.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.